GovMoneyNews -- July 11, 2025

Is there a valid defense of the Big, Beautiful Bill from a fiscal hawk perspective? Do Fed losses become taxpayer losses? Is there a "revolving door" from high places in Chicago to federal prisons?

Today’s Top Three Reads include an article at The Hill pointing out some inconsistencies underlying the Big, Beautiful Bill, an article at Cato Institute providing a “fiscal hawk” narrow defense of the bill, and an article at Politico asserting markets have expressed concern about the bill’s fiscal implications.

This daily newsletter gathers news and opinion about government finance and financial markets. My name is Bill Bergman. You can reach me at billbergman34@gmail.com

TOP THREE READS

The Hill

How GOP megabill fuels debt for future generations

From July 10, by Miriam Waldvogel, includes “President Trump’s newly passed One Big Beautiful Bill Act will, by most conventional estimates, add trillions to America’s national debt to pay for permanent tax cuts. Republicans insist the bill will unleash economic activity that offsets any lost tax revenue, but few economists agree. … The House Freedom Caucus blasted GOP senators for increasing deficit spending in the final version of the “big, beautiful bill.” “The Senate isn’t listening—their version adds over $1T to the deficit, completely ignoring the House framework,” Freedom Caucus member Rep. Keith Self (R-Texas) wrote June 30, before voting for it a few days later.”

Cato Institute

A fiscal hawk’s defense of the GOP’s deficit-busting budget bill

From July 10, by Adam Michel, includes “I would not have voted for the “One Big Beautiful Bill” that President Trump signed on July 4. The legislation adds trillions to the national debt, expands some of the worst tax subsidies, increases spending for parts of the government that are chronically overfunded, and includes many budget gimmicks. But it also does something Republicans haven’t had the courage to do in decades: it cuts spending below the prior-law baseline for programs previously thought untouchable: health care, food stamps, and green energy subsidies. That alone makes it worth taking seriously, not as the silver bullet many boosters are claiming, but as narrow proof of concept for future reforms.”

Politico

The GOP blew past debt warnings. The markets have noticed

From July 9, by Benjamin Guggenheim, includes “The whole episode was a stark display of how short-term rewards and Trump’s demands outweighed any anxieties about long-term calamity — even from a constituency as powerful as Wall Street, whose major players are reliable financiers for politicians of both parties. … Rather than send a big, beautiful signal to the bond markets that discipline would finally be restored, Republicans appear to have done the opposite: Yields on 10-year Treasuries have crept up around 18 basis points over the past week as market watchers ingested tariff news, but also openly wondered if either party is capable of reining in the roughly $36 trillion national debt.”

FEDERAL GOVERNMENT FINANCES

NC State College of Agriculture and Life Sciences

You decide: Is the national debt still a big worry?

From July 11, by Mike Walden, includes “The latest data show the total national debt is 121% of national income. This is more than twice the level in 2000, three times the level in the late 1960s, and it is a national record. … Currently annual interest payments for the national debt as a percent of GDP is 3.8%, higher than the 2.3% in 2020, but lower than the record 5% in 1991. However, the U.S. rate is among the highest compared to similar rates for other countries. … I’ve now been a professional economist for almost five decades, including over four decades teaching at NC State. I can’t count the number of times I’ve said the national debt is the “big issue of our generation.” Yet since I keep adding new generations to my proclamation, I wonder if I will ever see a day when I can say, “the debt was the big issue of past generations?” You decide.”

Daily Record

No one can grasp trillions. Here’s how to make sense of federal spending and debt

From July 5, by Ivo Welch, includes “I’ve been researching and teaching economics for more than 30 years, and still I can’t wrap my head around trillions of dollars. I’m guessing you can’t, either — and neither can our senators and representatives who determine the federal budget. And yet, our government insists on communicating with us in this unfathomable language. Worse, even our best media outlets rarely translate the government’s incomprehensible abstractions into understandable numbers … The government may have borrowed it, but ultimately you are on the hook for it. Feel better now? Probably not. For most people, learning that you owe $240,000 is a lot more concerning than hearing that the national debt is $37 trillion. And your piece of our collective problem is still growing. …”

BANKING AND FINANCIAL REGULATION

Board of Governors of the Federal Reserve System

Demystifying the Federal Reserve’s balance sheet

From July 10, by Fed Gov. Christopher Waller, includes “… I know from teaching this topic over the years to my undergraduate students that unless you are an accountant or a banker, you would probably rather go to the dentist than listen to a speech about the Fed's balance sheet. … Since the Fed supplies these reserves, one might ask what it costs taxpayers to supply a large amount of reserves. From the Treasury's point of view, its interest expense is the same regardless of who holds the short-term Treasury securities. So, the Fed can provide all the liquidity that banks need at zero marginal cost, which makes me wonder why some want to make reserves scarce. I often use the following analogy to drive this point home: If governments could provide clean, safe drinking water for citizens at zero cost, why would they make it scarce?”

Markets.com

Federal Reserve weighs balance sheet reduction and future interest rate hikes

From July 11, includes “… Waller also suggested that the Fed should adjust the structure of its balance sheet to hold more short-term assets, with long-term securities serving as a hedge against monetary liabilities. He noted that some market participants argue that the Fed’s balance sheet composition should mirror the structure of the Treasury market itself, with 20% allocated to short-term assets. Waller concluded, “That’s a reasonable point, but it would increase the duration of our balance sheet and expose the Fed to potential income losses, as we’ve seen in the past few years.” …”

American Banker

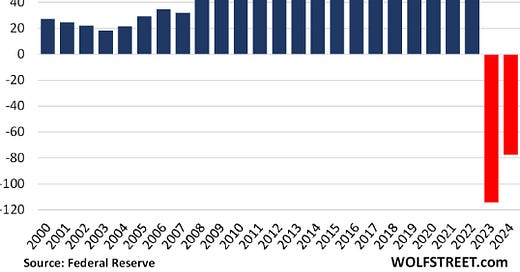

Waller says QE to blame for Fed losses on reserve interest

From July 10, by Kyle Campbell, includes “Federal Reserve Gov. Christopher Waller said the central bank does have a problem with income losses, but interest paid on reserves are not to blame.”

FinRegRag

From July 7, by Kayla Lahti, subtitled “How the Fed’s $3 billion HQ renovation exposes the need for an independent inspector general,” includes “Some may dismiss this controversy as little more than palace intrigue, but it highlights a deeper underlying issue. … independence in monetary policy does not justify a complete lack of accountability. Congress is the Fed’s boss. … A truly independent IG would have the authority to conduct comprehensive reviews of the Fed’s operations, including spending decisions, staffing practices, building projects, and internal governance. This authority would not involve second-guessing monetary policy, but would ensure regular, public accountability for how the Fed manages its resources.”

STATE AND LOCAL GOVERNMENT FINANCES

NBC Chicago

Ex-Ald. Ed Burke freed from prison after serving less than half his sentence

From July 8, by Chuck Goudie, Lisa Capitanini, Katy Smyser and Rose Schmidt, includes “Disgraced Chicago Ald. Edward M. Burke, the longest serving member ever in the Chicago City Council and simply known as “The Chairman” of the powerful Finance Committee, walked out of Thomson federal penitentiary in northwestern Illinois on Tuesday. Burke, 81, was released after serving less than 10 months of a two-year sentence for public corruption, stepping outside the wire on Tuesday … A fixture on Chicago’s political scene, Burke began his civil service career as a former Chicago police officer. He ended it as a convicted lawbreaker. … Former Justice Burke said that she dropped off her husband at a halfway house on Tuesday, and she was later seen at the Salvation Army Freedom Center in Chicago’s Humboldt Park. She said that her husband would be at the halfway house overnight. … Burke is expected to be moved to home confinement at some point and remain in the federal system until his projected release date of February 20, 2026. The next few months could involve Burke having to walk with an electronic bracelet secured to his ankle and very limited out-of-home travel.”

WTTW-TV News (Chicago)

Feds ask for 70 month prison sentence for former ComEd CEO Anne Pramaggiore

From July 8, by Matt Masterson, includes “Former Commonwealth Edison CEO Anne Pramaggiore should spend nearly six years in prison, according to federal prosecutors, after she was convicted of helping orchestrate a nearly decadelong conspiracy to bribe ex-Illinois House Speaker Michael Madigan. … “Over and over again, phony contracts, invoices, and false entries in ComEd’s books and records were employed to conceal the true recipients, the fact that the payments were being made in return for little to no work, and the nature of the payments to Madigan associates,” Assistant U.S. Attorney Sarah Streicker wrote in the sentencing memo. … Prosecutors alleged they plotted to give “a continuous stream of benefits” to “corruptly influence and reward Madigan” in order to get his support on Springfield legislation that would be massively beneficial to ComEd.”

FROM THE VAULTS

Chicago Tribune

Ex-Exelon CEO also quits as Chicago Fed Reserve chair

From October 2019, updated June 2024, by Ray Long, includes “The Exelon Utilities CEO who retired abruptly two weeks ago amid a wide-ranging federal investigation of lobbyist activities now has stepped down as chair of the Federal Reserve Bank of Chicago. … Pramaggiore released a statement on Wednesday that did not address the federal investigation, saying the Chicago Fed is “well-positioned to execute on its important mission.” … Even so, she’s leaving as federal authorities are looking into two companies where she had been a top executive. …”